Russia’s invasion of Ukraine has led to unimaginable suffering, all due to the machinations of the elite. The average Ukrainian or Russian citizen never wanted this. There are soldiers that want nothing more than to go home in peace.

History has taught us that war only leads to suffering and loss of innocent lives. I stand with Ukraine and hope that Western countries will step in to do more to help Ukrainians win this war.

Since this blog is focused on financial independence, there are some unintended financial lessons out of this war for the average citizen to consider.

Financial Lesson 1: Asset diversification

Under the weight of unprecedented financial sanctions from across the globe, the Russian financial and economic markets are in shambles.

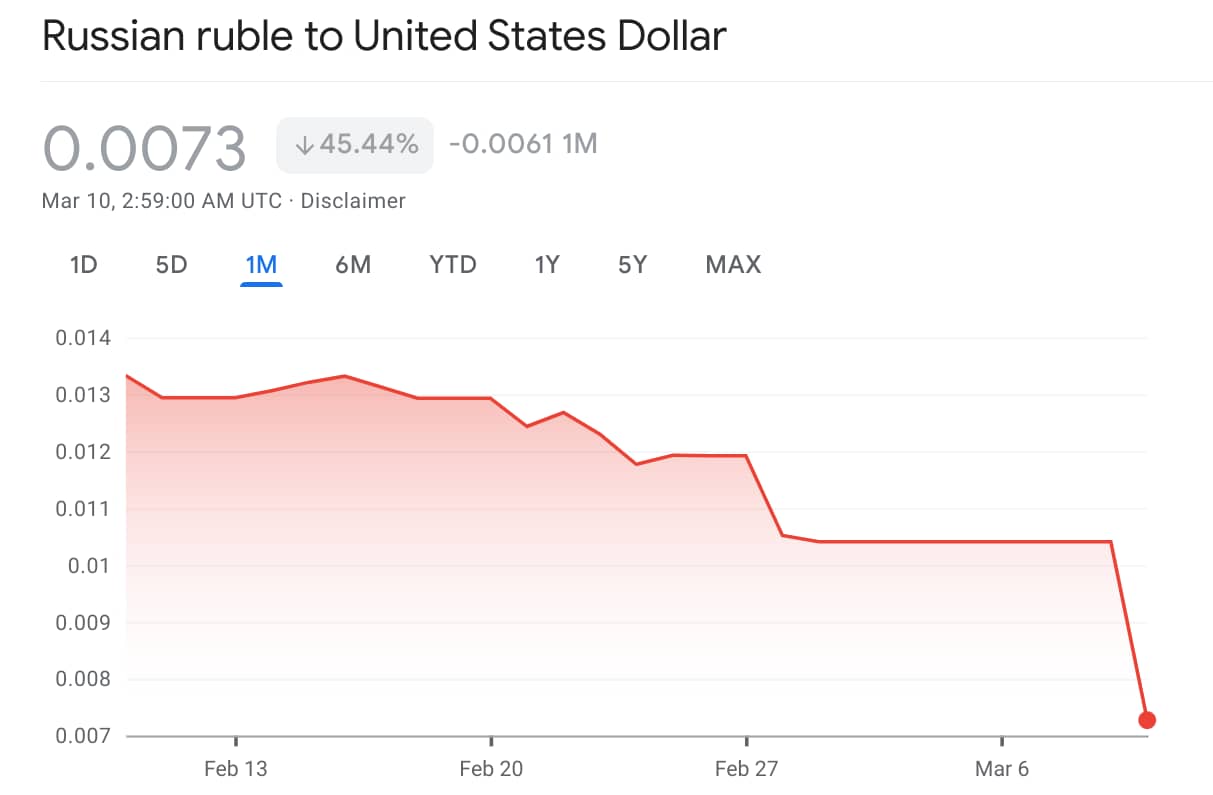

The Russian currency, the ruble, has plummeted by 40-45% since the start of the war.

To manage inflation and prop up the currency, the Russia raised its interest rates from 9.5% to 20%.

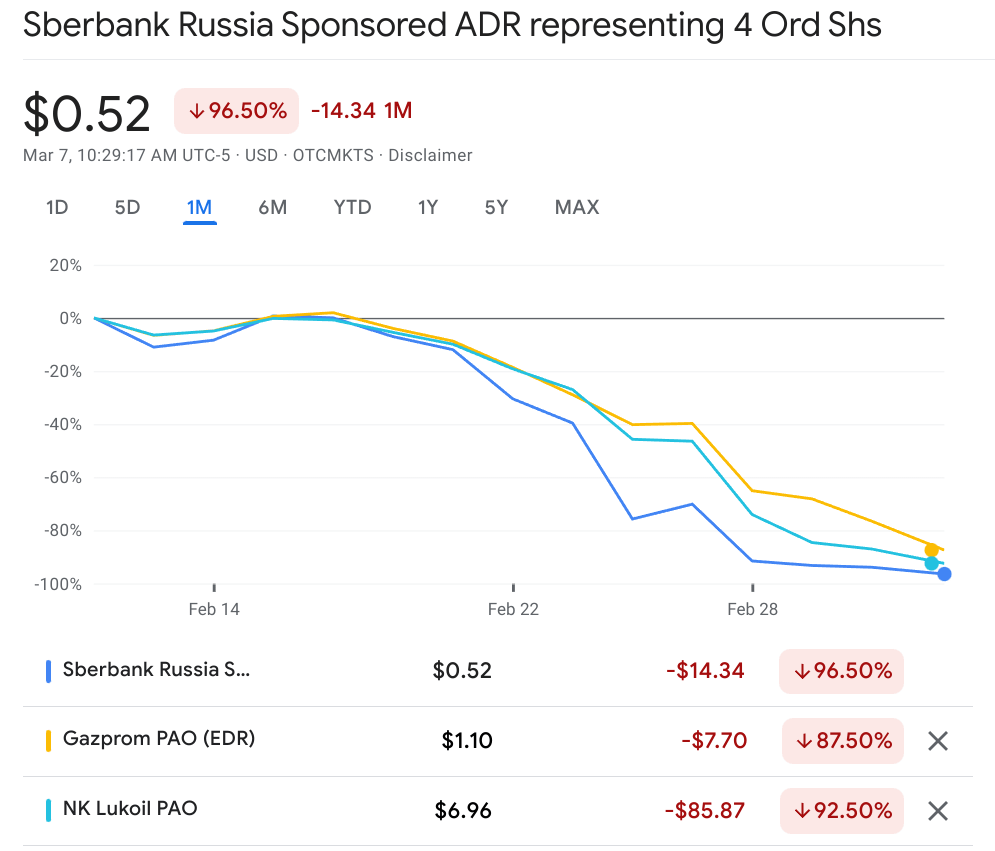

Since February 25, the Russian stock markets have remained closed. However, international exchanges trading Russian-focused equities have taken taken a nose dive of ~90%.

Russian government bonds are expected to default and now rated as junk bonds.

Imagine you were 100% invested in Russian equities, bonds or currency. The value of your investments or retirement plan have evaporated overnight.

This shows the importance of asset diversification to avoid concentration risk. Your portfolio won’t be wiped out due to factors outside of your control.

Financial Lesson 2: Liquidity and ability to access funds

Some financial bloggers recommend holding no emergency funds when your equity portfolio has grown to a sufficient size. “Just borrow or sell your equities when you need cash.”

For the average Russian, borrowing costs are now at 20%. Selling equities is impossible with a frozen stock market. The only choice might be withdrawals from their cash bank account.

You might think “We live in a stable country and this will never happen here.”

Never say never. Even the US stock markets were closed for almost a week after 9/11.

Don’t only focus on liquidity when you don’t have it. By then, it’s too late.

Instead of fully invested in the equity markets, make sure you have some cash on hand or the ability to access cash.

Financial Lesson 3: Spread your assets across borders

Russian oligarchs have some of their international assets frozen.

Russia has been removed from SWIFT, an international banking communication system to support transactions. Russians located outside of the country have limited ability to access funds from home.

Even Ukrainians were challenged by restricted cash withdrawals and suspended equity markets.

You might think “When all hell breaks loose in war, the last thing I am worried about is money”.

While this is true in the face of immediate danger, the hope is that you survive. At that point, how will you financially support yourself and your family? Do you just rely on the generosity of strangers to tide you through?

You should consider a contingency plan to protect your assets. Similar to insurance, it could protect you in an infrequent event (e.g., car accident, death, disability, etc.).

Some options could be:

- Invest or store value through cryptocurrency: the crypto markets have so far remained sanction-free. Crypto touts itself to be free of government or central bank control. I would be very surprised if Russia is unable to access crypto.

- Invest or store value in another country: unless you’re a multi-millionaire, expat or immigrant with ties to your home country, you might not have the ability to keep financial accounts in other countries. However, it is something worth considering for those able to do so.

For several years, I had an investment and chequing account in another country. There was some currency risk, as I invested using local currency. However, it gave me access to equities I was not able to get in Canada. When I consolidated my financial assets a while back, I closed all those accounts. However, I am starting to reconsider whether it’s better to manage my risk by keeping some funds overseas.

Financial challenges pale in comparison to the humanitarian crisis

These unintended financial lessons are miniscule and unimportant in the face of war and unspeakable suffering. Money means little when you’re fighting between life or death.

As the war rages on halfway around the world, there is little I can do beyond donating cash and hoping for peace. My only solace is writing about the small financial lessons that could be gleaned out of a catastrophic event.