Many popular quotes and sayings have said something similar to the following:

Everyone has a plan until they get punched in the mouth.

Mike Tyson

And boy, the markets and macro environment have recently packed a punch.

It’s worthwhile checking in to see if we’ve maintained our plan or abandoned ship.

Staying the course through slumping markets

Over 95%+ of our investable assets are in diversified ETFs, but we are not immune to the slumping equity markets. Our household’s largest holdings are in VEQT and XEQT. Both are down ~15% in 2022.

Although it hurts to see our portfolios decline double digits, we remain fully invested in the stock markets. We haven’t sold our positions to stash cash. We continue to buy on a bi-weekly basis when our paycheques roll in.

We also haven’t bought any individual company stocks. It sure has been tempting though. Some popular technology stock prices coming back down from the stratosphere to a more reasonable valuation. However, we remain committed to our diversified approach.

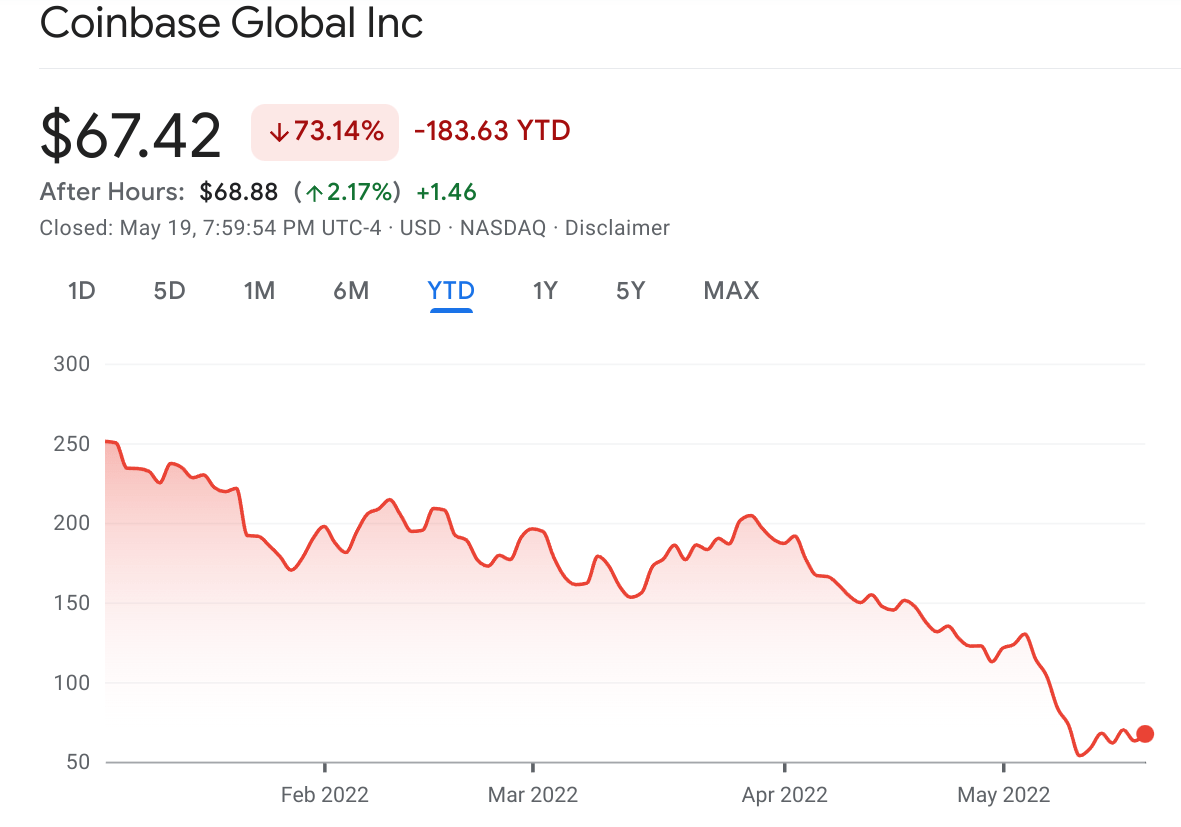

All I have to do is look back on my one-time investment in Coinbase. I had bought in at $319 and exited at $223. In a two month holding period, I lost 30%. I checked in recently and it’s down to $67 now. And this is why I don’t buy individual stocks anymore.

Disclosure: I hold very minor (<3.5% of total investable assets) positions in individual stocks. Most are legacy holdings in blue chip companies from many years ago. I also hold shares in my employer due to our ESOP program that gives a 25% employer top-up, but I sell it twice a year to reinvest back into diversified ETFs.

Repaying the mortgage through rising interest rates

Even though our variable mortgage interest rate has risen 0.75% in a matter of weeks, we have continued our mortgage repayment plans. It hurts the wallet to increase our payments to match the interest rate increases. But we are intent on repaying our mortgage in 15-20 years.

If interest rates go up another 2-3%, we will have to re-evaluate our ability to match our payments to rate increases. At some point, we will not have enough cash to continue this. But until then, we are staying the course.

Changing our savings plan due to job risk

Mr. LJ recently started a new job with a technology company. After joining for the first few months, the company announced a hiring freeze and a plan to reduce costs to shore up profitability. Needless to say, we were extremely concerned about potential job loss.

Immediately, I pivoted away from our initial savings plan by cancelling any further contributions to Mr. LJ’s RRSP.

The thinking was any income loss would mean his 2022 taxable income wouldn’t hit the higher income tax brackets to make a RRSP deduction worthwhile. So we kept the cancelled contributions as cash.

But is there a better approach? If this job loss doesn’t materialize, have we been too conservative?

Why pause contributions when we have an emergency fund?

We have a healthy emergency fund meant to cover unexpected expenses and job loss. There’s no need for us to bank extra cash.

Relooking at our situation, Mr. LJ has both RRSP and TFSA contribution room remaining. The initial savings plan was to equally contribute into both accounts. But we don’t want to contribute anymore into the RRSP until we have a better handle on whether this job loss will materialize.

A better approach would be to redirect the RRSP contributions into Mr. LJ’s TFSA. This means total contributions remain the same as the initial plan. The only difference would be the contribution mix shifts from 50% RRSP / 50% TFSA to become 100% TFSA.

This gives us some flexibility, as we can always withdraw from the TFSA without penalties, whereas RRSP withdrawals are taxable.

As we come closer to the end of the year and the job loss risk has subsided, we can then switch contributions to 100% RRSP to make up for the suspended contributions.

Sticking to the best laid plans

Overall, I’d say our “plans have survived first contact with the enemy”. Our total savings remain on plan, but we will tweak the timing of the contributions into each investment account.